With the interconnectedness of economies and the rise of multinational corporations, sending money abroad is now more common than ever. Whether you’re sending money to family abroad, paying tuition abroad, or maintaining a business partnership, international bank transfers are an important part of your financial transactions. However, what many people and organizations overlook are the …

Insurance is not just a safety net. It is an essential part of modern society. It offers security, encourages development, and guarantees that both businesses and individuals overcome unexpected difficulties. For insurance for property, healthcare or life insurance, it is essential to manage risk and ensure economic stability. This blog examines the primary factors that make insurance so …

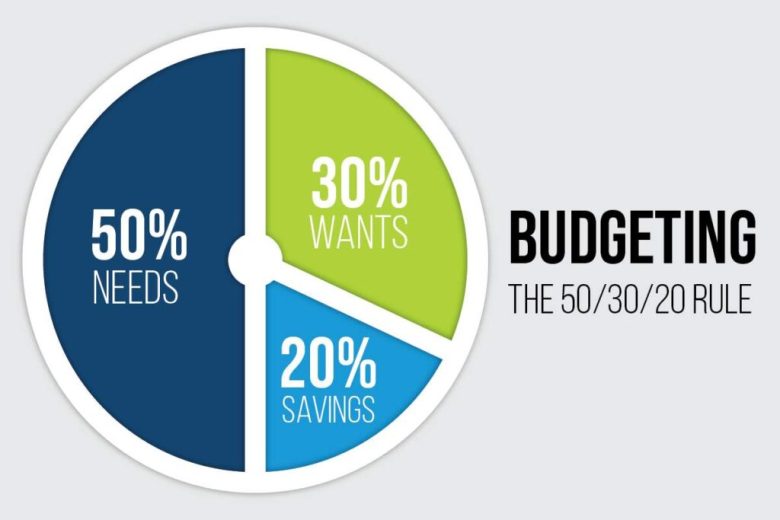

Everyone wants to get better at managing their finances, but it can be difficult to know where to start. It’s easy to get lost in a sea of spending tips, complicated spreadsheets, and endless numbers. The 50/30/20 rule is a useful approach that’s praised for its clarity and ease of use. This budgeting method can …

People often discuss insurance, premiums, and paperwork, but its true value goes much further than that. Whether you want to protect your family, keep your money safe, or plan for the future, insurance plays a vital role in becoming financially stable and strong. This article discusses seven key reasons why insurance is an important part …

An emergency fund is a financial safety net designed to cover unexpected expenses, such as a medical emergency, car repairs, or unexpected job loss. Without this buffer, people may have to resort to loans or credit cards. Such situations can lead to financial stress and debt. An emergency fund can help you feel secure and …

Many insurance companies offer benefits that customers don’t ask for or are unaware of. Different auto, home, health, and life insurance policies offer different discounts, some of which are automatic and others are required. Common discounts include safety features, loyalty rewards, combined policies, excellent driving records, professional connections, and payment method discounts. Advanced risk algorithms …

A centralized system that stores all financial data is the foundation of a professional financial organization. This digital or physical hub should contain information about bank accounts, investments, loans, insurance, taxes, and fixed accounts. Many people use password-protected, cloud-based financial dashboards or applications that aggregate accounts from multiple institutions. If you prefer a physical system, …

Bank statements are financial report cards that detail account activity, but many people ignore them. These documents contain important information about deposits, withdrawals, charges, and fraud that can impact your finances. Reading each statement (paper or digital) can help you understand your spending habits, identify problems quickly, and improve your financial control. Some banks provide …

Okay, let’s be honest: No one likes bank fees. Yet, many of us still pay them every month without even realizing it. These hidden fees, such as monthly maintenance fees and bank fees, can slowly eat away at your savings. Such behavior is annoying, especially if you’re trying to use your money wisely. These fees …

Unlike the rest, traditional budgeting relies on history, while ZBB requires justification for all expenses in the upcoming period. Whether corporate or personal finance, budgeting always plays a pivotal role. This article will discuss different aspects of zero-based budgeting, including advantages and challenges to adopting ZBB, its principles, and how to begin implementing it. The …