Everyone wants to get better at managing their finances, but it can be difficult to know where to start. It’s easy to get lost in a sea of spending tips, complicated spreadsheets, and endless numbers. The 50/30/20 rule is a useful approach that’s praised for its clarity and ease of use. This budgeting method can help you get better at managing your finances without having to do a lot of math or spend hours tracking your spending.

This article explains the 50/30/20 rule, how it works, and why many financial experts believe it’s the best way to manage your money. You’ll learn how to use it, its key benefits, and the tools that can help you stay on track. By the end of the day, you’ll have a clear plan for how to align your finances with your goals, whether you’re saving for a trip, paying off debt, or just making budgeting easier.

How to Understand the 50/30/20 Rule:

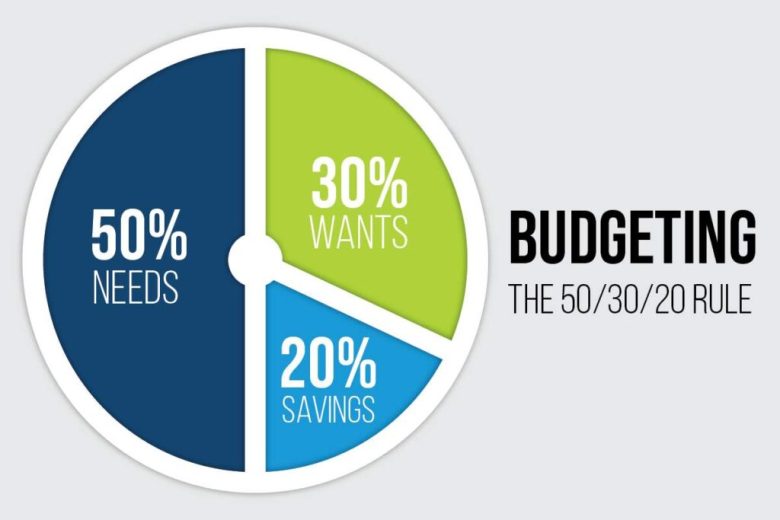

When you’re budgeting, the 50/30/20 rule dictates that you divide your net income into three main categories. Elizabeth Warren and her daughter Amelia Warren Tyagi came up with this rule in their book All Your Worth. Warren is a U.S. senator and an expert on bankruptcy law. It’s simple enough that anyone can use it and adaptable enough to work in a wide variety of financial situations.

The idea is simple to understand. Each month, you set aside 50% of your income for essentials, 30% for necessities, and 20% for savings and debt repayment. This approach simplifies your spending and enables you to maintain a balance between current expenses and future planning. No matter how much money you make now, with a little planning, you can easily adjust your spending to fit those numbers.

Sort by Percentage:

The 50/30/20 rule works best when you keep it simple. By using clear groups and percentages, you can quickly see where your money is going each month and what needs to be changed.

50% for Needs

Half of your salary should be enough to meet your basic needs. You cannot delay these needs; they must persist regardless of your financial situation. These include things like rent or mortgage, utilities, food, health insurance, minimum loan payments, and transportation expenses. At this point, it is important to distinguish between needs and wants. For example, paying the electric bill is a need, but buying a new phone is a want.

30% for Wants

The next 30% is for things that make life more enjoyable and comfortable but aren’t essential to your health. Wants include going to the movies, eating out, having a Netflix account, joining the gym, and buying new clothes. It may help you spend less, but it will make life more interesting. The 50/30/20 rule doesn’t mean you have to give up your favorite activities; it just ensures that you don’t spend too much on your favorite treats.

20% for Savings and Debt Repayment

You can use the remaining twenty percent for future planning and financial protection. This means putting money into your retirement accounts, emergency reserves, investments, and bills, and paying more than the minimum amount owed. It is advisable to prioritize settling your credit card debt and other high-interest bills first. Once you’re debt-free, you can start focusing on saving for the future. Setting aside a certain amount each month to save and pay off debt can bring you closer to financial freedom in the long run.

Putting the 50/30/20 Rule into Practice:

I love using the 50/30/20 rule because it’s simple. First, calculate your net monthly income. Then, list all of your expenses and divide them into three categories: needs, wants, savings, and debt repayment. If you find that your spending doesn’t match the rules, don’t worry. Start with small changes. For example, you could eat fast food instead of home-cooked food or rack up a small amount of credit card debt this month.

Remember, you’re aiming for growth, not perfection. Even if you only obey the rules partially, you’ll notice a difference in your financial situation. Many people find it helpful to regularly review their budget and make adjustments based on changes in income and expenses. Over time, you’ll become more aware of how you’re spending your money and be better able to make choices that align with your financial goals.

Why the 50/30/20 Rule is a Good Idea:

The 50/30/20 rule is useful because it’s easy to understand. You don’t need to know a lot of math or business jargon. Budgeting is less complicated because it has a clear plan. This arrangement allows even people who have struggled with money management in the past to do it. This rule also leaves room for fun and freedom, so you don’t miss out on the things that make you happy.

This formula also makes you think about your buying habits, so you know what you need and what you want. Over time, this difference can help you control your impulses and strengthen your willpower. Make sure you build up savings and long-term debt so that you can stay financially healthy in the long run while enjoying the present.

How to Apply the Rules to Your Situation:

That said, the 50/30/20 rule is a beneficial place to start, but everyone’s financial situation is different. In cities with high living expenses, your “needs” might exceed 50%. If you want to reach a big goal quickly, you can choose to save more and spend less on things you don’t need.

The beauty of this rule is that it is adaptable. You can use it as a guideline and change the numbers as needed. Some people have a 60/20/20 or 70/20/10 ratio at certain points in their lives. The most important thing is to have a system that allows you to make informed decisions about how to spend your money regularly. Review your budget regularly and adjust your spending as your goals, income, and expenses change.

Problems Most People Face and How to Fix Them:

The 50/30/20 rule is not perfect, and neither are any planning systems. Some people have a challenging time putting expenses into the right category, especially when an item seems to be both a need and a want. Some people struggle to cut back on spending and may need to temporarily save more than 20% to pay off debt.

Being honest about your habits and goals is the best way to solve problems. Remember that mistakes happen. If you get stuck, don’t be afraid to ask for help. Keep track of your spending and use digital tools to spot trends. If your income changes regularly, it’s best to base your spending on your average monthly income. It would be helpful to start with one minor adjustment every month. Small steps forward add up over time.

Apps and Tools to Help You Budget:

Nowadays, planning apps make it much easier to follow the 50/30/20 rule. Apps like Mint, YNAB (You Need a Budget), and EveryDollar let you set up your categories, track your progress, and change your spending on the fly. Many of these apps even let you view your spending, allowing you to spot patterns and make quick changes.

Digital spreadsheets are another good, less expensive option. Most banks also list their offers on their websites, which can help you create your first budget. With the right tools, tracking your finances and sticking to your budget has never been easier.

FAQs:

1. What if the price of something I need is more than half of my income?

If your needs are higher than 50% because of fixed costs like rent and insurance, don’t worry. Change those numbers now and, if possible, investigate how to reduce those costs in the long run.

2. Should I spend as much money as I “want” each month?

You don’t have to spend the full 30% on what you want. You can save the extra money or transfer it to a special purchase later.

3. How should I handle irregular income with this rule?

Create a budget based on how much you earn each month on average. As you earn more money, you can save the extra money or pay off your debt.

4. Can the 50/30/20 rule help you get out of debt faster?

Yes! The formula shows that you should use 20% of your income to save and pay off debt. If you have extra money, you can invest it in the same area and speed up progress.

5. Does the 50/30/20 rule apply to families and singles?

Absolutely. This rule applies to singles, couples, and groups. Use these rules to figure out how much money your household earns and spends.